The accrual basis of accounting — AccountingTools

Now let’s turn to the assets section of your beginning balance sheet. What do you have to show for your $275,000 in liabilities and owner’s equity? Of this amount, $50,000 is in cash—that is, money deposited in the company’s checking and other bank accounts. You used another $75,000 to pay for inventory that you’ll sell throughout the year. Finally, you spent $150,000 on several long-term assets, including a sign for the store, furniture, store displays, and computer equipment.

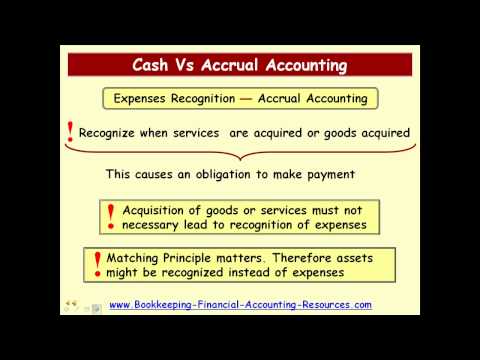

The commission is also an accrued liability on the balance sheet for the delivery period, but not for the next period when the commission (cash) is paid out to the salesperson. The upside is that the accrual basis gives a more realistic idea of income and expenses during a period of time, therefore providing a long-term picture of the business that cash accounting can’t provide. The cash basis of accounting recognizes revenues when cash is received, and expenses when they are paid. This method does not recognize accounts receivable or accounts payable. The difference between cash and accrual accounting lies in the timing of when sales and purchases are recorded in your accounts.

While it does provide a more accurate picture of a business’s current condition, it is relatively complex and more expensive to implement than the cash accounting method. The method of accounting that measures the performance and position of a company by recognizing economic activity regardless of whether cash transaction occurs is called What is bookkeeping. Not sure what method you should use to manage your books, or which one is best suited to your business? Here’s a quick guide to help you understand cash and accrual accounting, and the pros and cons of each method. The advantage of cash-based accounting is simplicity.

Accrual basis accounting recognizes revenue when the service is provided for the customer even though cash isn’t yet in the bank yet. For example, if a company has a repair done for $10,000 on August 15 and the vendor allows for payment on September 15.

Companies that use accrual accounting sell on credit, so projects that provide revenue streams over a long period of time affect the company’s financial condition at the point of transaction. It makes sense to use accrual accounting so that these events can be reflected in the financial statements during the same reporting period that these transactions occur.

The first three entries should reverse in the following month. Income taxes are typically retained as accrued expenses until paid. Income taxes are accrued based on income earned. Debit to income tax expense, credit to accrued expenses.

Adjusting entries are required at the end of each fiscal period to align the revenues and expenses to the “right” period, in accord with the matching principle in accounting. Let’s take an example of a start-up company (Y) with an employee (Joe) who is under a cliff vesting plan, and who is also getting a vesting schedule incentive after five years of commitment.

There is a possibility that you may not have received the payment by cash at that particular point in time. Till that time the https://www.bookstime.com/ amount of Rs 1,00,000 becomes your account receivable because the customer will pay that amount before the period expires.

Which Method Should Your Business Use?

- If you use accrual accounting, you record expenses and sales when they take place, instead of when cash changes hands.

- Additionally, it conforms to nationally accepted accounting standards.

- There are lots of rules around who can and can’t do this.

- Accrual accounting is considered to provide a more accurate reflection of business activity than cash accounting.

- The time period could vary from 30-days to a few months.

- However, as the cost of your accountant relates to the financial year, this cost should be accrued before the year ends.

Unlike cash accounting, which provides a clear short-term vision of a company’s financial situation, accrual accounting lets you see a more long-term view of how your company is faring. The Generally Accepted Accounting Principles, or GAAP, are the standard framework of rules and guidelines that accountants must adhere to when preparing a business’s financial statements in the United States. Under these guidelines, all companies with sales of over $25 million must use the accrual method when bookkeeping and reporting their financial performance. This means that if your business were to grow larger than $25 million in sales, you would need to update your accounting practices. If you think your business could exceed $25 million in sales in the near future, you might want to consider opting for the accrual accounting method when you’re setting up your accounting system.

If companies incurred expenses (i.e., received goods/services) but didn’t pay for them with cash yet, then they need to be accrued. An expense is occurred or recorded when the raw material is ordered and not when the actual payment is made to the supplier by either cash or cheque. The only drawback of this type of accounting system is that you, as a firm, might end up paying tax on revenues even when you might have not received it (credit). Accrual accounting provides a more accurate picture of a company’s financial position, while cash accounting is often reserved for very small businesses. To add to the confusion, some legalistic accounting systems take a simplistic view of ‘accrued revenue’ and ‘accrued expenses», defining each as revenue or expense that has not been formally invoiced. This is primarily due to tax considerations, since in some countries, the act of issuing an invoice creates taxable revenue, even if the customer does not ultimately pay and the related receivable becomes noncollectable.

Public companies that trade shares on stock exchanges are required to follow generally accepted accounting principles (GAAP), which require accrual-based accounting, as investors want the most accurate picture possible of the state of a company’s finances. If in doubt, check with your accountant as to which method you should use. Many sole proprietorships and small businesses use cash basis accounting; however, accrual basis accounting is the method of accounting most businesses and professionals are required to use by law in the United States and Canada. Among the other advantages to using business accounting software, using an accounting software package can greatly simplify accrual accounting. Accrual basis accounting gives the most accurate picture of the financial state of your business.

Depreciation expense is used to better reflect the expense and value of a long-term asset as it relates to the revenue it generates. The Financial Accounting Standards Boards (FASB) has set out Generally Accepted Accounting Principles (GAAP) in the U.S. dictating when and how companies should accrue for certain things. For example, “Accounting for Compensated Absences” requires employers to accrue a liability for future vacation days for employees. Learn more about this example at FASB’s website.

Advantages of accrual accounting

February. Because the utility companies do not bill their customers for the current month but for the next month, the accountant pays the utility bills of February in March and of March in April and so on. The company’s accountant has to adjust the entries in the financial statement so that the payments of the bills are reported as accrued expenses.

But the credit sales will also be treated as sales and the profit would be generated by including both the cash and credit sales and then deducting the cost of goods sold and the operating expenses. Let us now look at another practical example of an https://www.bookstime.com/management-accounting basis.

When the payment comes in, the receivable goes flat, meaning it’s been satisfied by the payment. Accrual accounting is considered to provide a more accurate reflection of business activity than cash accounting.